Note

Click here to download the full example code

Tutorial for conformalized quantile regression (CQR)¶

We will use the sklearn california housing dataset as the base for the

comparison of the different methods available on MAPIE. Two classes will

be used: MapieQuantileRegressor for CQR

and MapieRegressor for the other methods.

For this example, the estimator will be LGBMRegressor with

objective="quantile" as this is a necessary component for CQR, the

regression needs to be from a quantile regressor.

For the conformalized quantile regression (CQR), we will use a split-conformal

method meaning that we will split the training set into a training and

calibration set. This means using

MapieQuantileRegressor with cv="split"

and the alpha parameter already defined. Recall that the alpha is

1 - target coverage.

For the other type of conformal methods, they are chosen with the

parameter method of MapieRegressor and the

parameter cv is the strategy for cross-validation. In this method, to use a

“leave-one-out” strategy, one would have to use cv=-1 where a positive

value would indicate the number of folds for a cross-validation strategy.

Note that for the jackknife+ after boostrap, we need to use the

class Subsample (note that the alpha parameter is

defined in the predict for these methods).

import warnings

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

from lightgbm import LGBMRegressor

from matplotlib.offsetbox import AnnotationBbox, TextArea

from matplotlib.ticker import FormatStrFormatter

from scipy.stats import randint, uniform

from sklearn.datasets import fetch_california_housing

from sklearn.model_selection import KFold, RandomizedSearchCV, train_test_split

from mapie.metrics import (regression_coverage_score,

regression_mean_width_score)

from mapie.regression import MapieQuantileRegressor, MapieRegressor

from mapie.subsample import Subsample

random_state = 18

rng = np.random.default_rng(random_state)

round_to = 3

warnings.filterwarnings("ignore")

1. Data¶

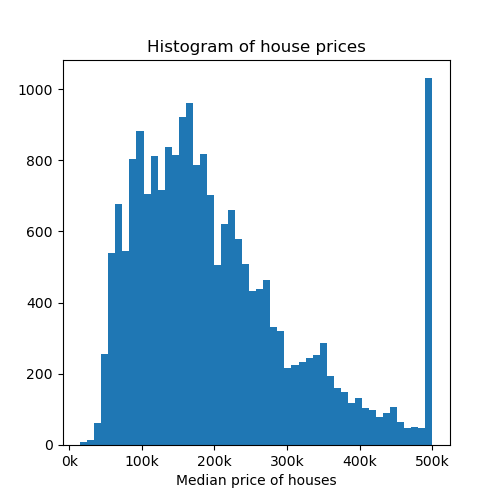

The target variable of this dataset is the median house value for the California districts. This dataset is composed of 8 features, including variables such as the age of the house, the median income of the neighborhood, the average numbe rooms or bedrooms or even the location in latitude and longitude. In total there are around 20k observations. As the value is expressed in thousands of $ we will multiply it by 100 for better visualization (note that this will not affect the results).

data = fetch_california_housing(as_frame=True)

X = pd.DataFrame(data=data.data, columns=data.feature_names)

y = pd.DataFrame(data=data.target) * 100

Let’s visualize the dataset by showing the correlations between the independent variables.

df = pd.concat([X, y], axis=1)

pear_corr = df.corr(method='pearson')

pear_corr.style.background_gradient(cmap='Greens', axis=0)

Now let’s visualize a histogram of the price of the houses.

fig, axs = plt.subplots(1, 1, figsize=(5, 5))

axs.hist(y, bins=50)

axs.set_xlabel("Median price of houses")

axs.set_title("Histogram of house prices")

axs.xaxis.set_major_formatter(FormatStrFormatter('%.0f' + "k"))

plt.show()

Let’s now create the different splits for the dataset, with a training, calibration and test set. Recall that the calibration set is used for calibrating the prediction intervals.

X_train, X_test, y_train, y_test = train_test_split(

X,

y['MedHouseVal'],

random_state=random_state

)

X_train, X_calib, y_train, y_calib = train_test_split(

X_train,

y_train,

random_state=random_state

)

2. Optimizing estimator¶

Before estimating uncertainties, let’s start by optimizing the base model

in order to reduce our prediction error. We will use the

LGBMRegressor in the quantile setting. The optimization

is performed using RandomizedSearchCV

to find the optimal model to predict the house prices.

estimator = LGBMRegressor(

objective='quantile',

alpha=0.5,

random_state=random_state

)

params_distributions = dict(

num_leaves=randint(low=10, high=50),

max_depth=randint(low=3, high=20),

n_estimators=randint(low=50, high=100),

learning_rate=uniform()

)

optim_model = RandomizedSearchCV(

estimator,

param_distributions=params_distributions,

n_jobs=-1,

n_iter=10,

cv=KFold(n_splits=5, shuffle=True),

verbose=0,

random_state=random_state

)

optim_model.fit(X_train, y_train)

estimator = optim_model.best_estimator_

3. Comparison of MAPIE methods¶

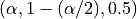

We will now proceed to compare the different methods available in MAPIE used for uncertainty quantification on regression settings. For this tutorial we will compare the “naive”, “Jackknife plus after Bootstrap”, “cv plus” and “conformalized quantile regression”. Please have a look at the theoretical description of the documentation for more details on these methods.

We also create two functions, one to sort the dataset in increasing values

of y_test and a plotting function, so that we can plot all predictions

and prediction intervals for different conformal methods.

def sort_y_values(y_test, y_pred, y_pis):

"""

Sorting the dataset in order to make plots using the fill_between function.

"""

indices = np.argsort(y_test)

y_test_sorted = np.array(y_test)[indices]

y_pred_sorted = y_pred[indices]

y_lower_bound = y_pis[:, 0, 0][indices]

y_upper_bound = y_pis[:, 1, 0][indices]

return y_test_sorted, y_pred_sorted, y_lower_bound, y_upper_bound

def plot_prediction_intervals(

title,

axs,

y_test_sorted,

y_pred_sorted,

lower_bound,

upper_bound,

coverage,

width,

num_plots_idx

):

"""

Plot of the prediction intervals for each different conformal

method.

"""

axs.yaxis.set_major_formatter(FormatStrFormatter('%.0f' + "k"))

axs.xaxis.set_major_formatter(FormatStrFormatter('%.0f' + "k"))

lower_bound_ = np.take(lower_bound, num_plots_idx)

y_pred_sorted_ = np.take(y_pred_sorted, num_plots_idx)

y_test_sorted_ = np.take(y_test_sorted, num_plots_idx)

error = y_pred_sorted_-lower_bound_

warning1 = y_test_sorted_ > y_pred_sorted_+error

warning2 = y_test_sorted_ < y_pred_sorted_-error

warnings = warning1 + warning2

axs.errorbar(

y_test_sorted_[~warnings],

y_pred_sorted_[~warnings],

yerr=np.abs(error[~warnings]),

capsize=5, marker="o", elinewidth=2, linewidth=0,

label="Inside prediction interval"

)

axs.errorbar(

y_test_sorted_[warnings],

y_pred_sorted_[warnings],

yerr=np.abs(error[warnings]),

capsize=5, marker="o", elinewidth=2, linewidth=0, color="red",

label="Outside prediction interval"

)

axs.scatter(

y_test_sorted_[warnings],

y_test_sorted_[warnings],

marker="*", color="green",

label="True value"

)

axs.set_xlabel("True house prices in $")

axs.set_ylabel("Prediction of house prices in $")

ab = AnnotationBbox(

TextArea(

f"Coverage: {np.round(coverage, round_to)}\n"

+ f"Interval width: {np.round(width, round_to)}"

),

xy=(np.min(y_test_sorted_)*3, np.max(y_pred_sorted_+error)*0.95),

)

lims = [

np.min([axs.get_xlim(), axs.get_ylim()]), # min of both axes

np.max([axs.get_xlim(), axs.get_ylim()]), # max of both axes

]

axs.plot(lims, lims, '--', alpha=0.75, color="black", label="x=y")

axs.add_artist(ab)

axs.set_title(title, fontweight='bold')

We proceed to using MAPIE to return the predictions and prediction intervals.

We will use an  , this means a target coverage of 0.8

(recall that this parameter needs to be initialized directly when setting

, this means a target coverage of 0.8

(recall that this parameter needs to be initialized directly when setting

MapieQuantileRegressor and when using

MapieRegressor, it needs to be set in the

predict).

Note that for the CQR, there are two options for cv:

cv="split"(by default), the split-conformal where MAPIE trains the model on a training set and then calibrates on the calibration set.cv="prefit"meaning that you can train your models with the correct quantile values (must be given in the following order: and given to MAPIE as an iterable

object. (Check the examples for how to use prefit in MAPIE)

and given to MAPIE as an iterable

object. (Check the examples for how to use prefit in MAPIE)

Additionally, note that there is a list of accepted models by

MapieQuantileRegressor

(quantile_estimator_params) and that we will use symmetrical residuals.

STRATEGIES = {

"naive": {"method": "naive"},

"cv_plus": {"method": "plus", "cv": 10},

"jackknife_plus_ab": {"method": "plus", "cv": Subsample(n_resamplings=50)},

"cqr": {"method": "quantile", "cv": "split", "alpha": 0.2},

}

y_pred, y_pis = {}, {}

y_test_sorted, y_pred_sorted, lower_bound, upper_bound = {}, {}, {}, {}

coverage, width = {}, {}

for strategy, params in STRATEGIES.items():

if strategy == "cqr":

mapie = MapieQuantileRegressor(estimator, **params)

mapie.fit(

X_train, y_train,

X_calib=X_calib, y_calib=y_calib,

random_state=random_state

)

y_pred[strategy], y_pis[strategy] = mapie.predict(X_test)

else:

mapie = MapieRegressor(estimator, **params, random_state=random_state)

mapie.fit(X_train, y_train)

y_pred[strategy], y_pis[strategy] = mapie.predict(X_test, alpha=0.2)

(

y_test_sorted[strategy],

y_pred_sorted[strategy],

lower_bound[strategy],

upper_bound[strategy]

) = sort_y_values(y_test, y_pred[strategy], y_pis[strategy])

coverage[strategy] = regression_coverage_score(

y_test,

y_pis[strategy][:, 0, 0],

y_pis[strategy][:, 1, 0]

)

width[strategy] = regression_mean_width_score(

y_pis[strategy][:, 0, 0],

y_pis[strategy][:, 1, 0]

)

We will now proceed to the plotting stage, note that we only plot 2% of the observations in order to not crowd the plot too much.

perc_obs_plot = 0.02

num_plots = rng.choice(

len(y_test), int(perc_obs_plot*len(y_test)), replace=False

)

fig, axs = plt.subplots(2, 2, figsize=(15, 13))

coords = [axs[0, 0], axs[0, 1], axs[1, 0], axs[1, 1]]

for strategy, coord in zip(STRATEGIES.keys(), coords):

plot_prediction_intervals(

strategy,

coord,

y_test_sorted[strategy],

y_pred_sorted[strategy],

lower_bound[strategy],

upper_bound[strategy],

coverage[strategy],

width[strategy],

num_plots

)

lines_labels = [ax.get_legend_handles_labels() for ax in fig.axes]

lines, labels = [sum(_, []) for _ in zip(*lines_labels)]

plt.legend(

lines[:4], labels[:4],

loc='upper center',

bbox_to_anchor=(0, -0.15),

fancybox=True,

shadow=True,

ncol=2

)

plt.show()

We notice more adaptability of the prediction intervals for the conformalized quantile regression while the other methods have fixed interval width. Indeed, as the prices get larger, the prediction intervals are increased with the increase in price.

def get_coverages_widths_by_bins(

want,

y_test,

y_pred,

lower_bound,

upper_bound,

STRATEGIES,

bins

):

"""

Given the results from MAPIE, this function split the data

according the the test values into bins and calculates coverage

or width per bin.

"""

cuts = []

cuts_ = pd.qcut(y_test["naive"], bins).unique()[:-1]

for item in cuts_:

cuts.append(item.left)

cuts.append(cuts_[-1].right)

cuts.append(np.max(y_test["naive"])+1)

recap = {}

for i in range(len(cuts) - 1):

cut1, cut2 = cuts[i], cuts[i+1]

name = f"[{np.round(cut1, 0)}, {np.round(cut2, 0)}]"

recap[name] = []

for strategy in STRATEGIES:

indices = np.where(

(y_test[strategy] > cut1) * (y_test[strategy] <= cut2)

)

y_test_trunc = np.take(y_test[strategy], indices)

y_low_ = np.take(lower_bound[strategy], indices)

y_high_ = np.take(upper_bound[strategy], indices)

if want == "coverage":

recap[name].append(regression_coverage_score(

y_test_trunc[0],

y_low_[0],

y_high_[0]

))

elif want == "width":

recap[name].append(

regression_mean_width_score(y_low_[0], y_high_[0])

)

recap_df = pd.DataFrame(recap, index=STRATEGIES)

return recap_df

bins = list(np.arange(0, 1, 0.1))

binned_data = get_coverages_widths_by_bins(

"coverage",

y_test_sorted,

y_pred_sorted,

lower_bound,

upper_bound,

STRATEGIES,

bins

)

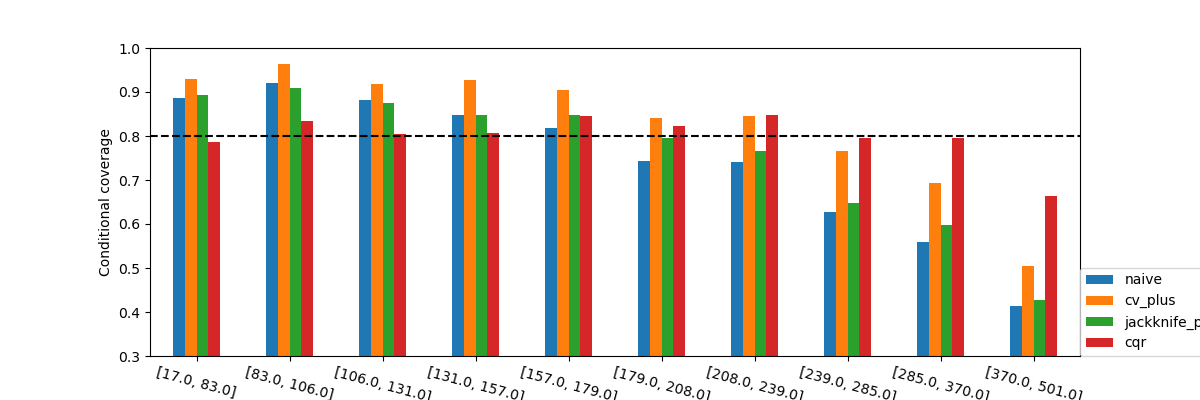

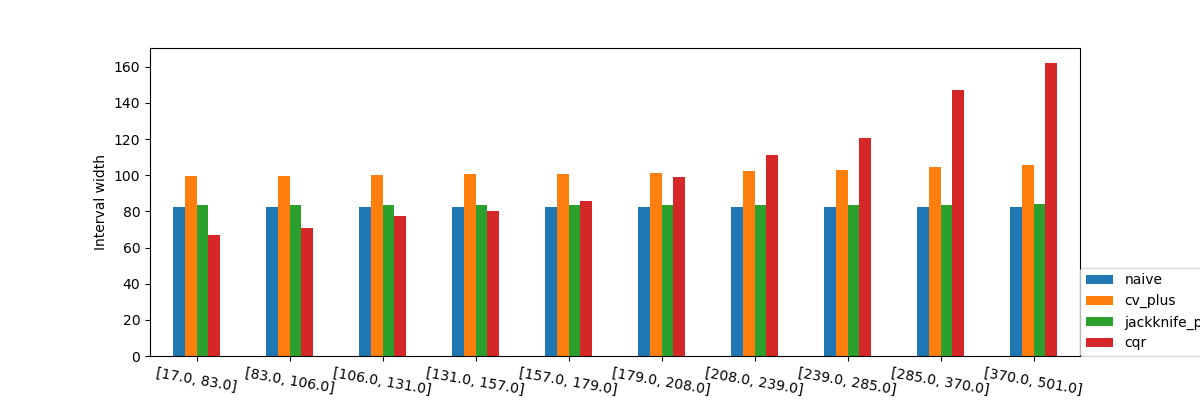

To confirm these insights, we will now observe what happens when we plot the conditional coverage and interval width on these intervals splitted by quantiles.

binned_data.T.plot.bar(figsize=(12, 4))

plt.axhline(0.80, ls="--", color="k")

plt.ylabel("Conditional coverage")

plt.xlabel("Binned house prices")

plt.xticks(rotation=345)

plt.ylim(0.3, 1.0)

plt.legend(loc=[1, 0])

plt.show()

What we observe from these results is that none of the methods seems to

have conditional coverage at the target  . However, we can

clearly notice that the CQR seems to better adapt to large prices. Its

conditional coverage is closer to the target coverage not only for higher

prices, but also for lower prices where the other methods have a higher

coverage than needed. This will very likely have an impact on the widths

of the intervals.

. However, we can

clearly notice that the CQR seems to better adapt to large prices. Its

conditional coverage is closer to the target coverage not only for higher

prices, but also for lower prices where the other methods have a higher

coverage than needed. This will very likely have an impact on the widths

of the intervals.

binned_data = get_coverages_widths_by_bins(

"width",

y_test_sorted,

y_pred_sorted,

lower_bound,

upper_bound,

STRATEGIES,

bins

)

binned_data.T.plot.bar(figsize=(12, 4))

plt.ylabel("Interval width")

plt.xlabel("Binned house prices")

plt.xticks(rotation=350)

plt.legend(loc=[1, 0])

plt.show()

When observing the values of the the interval width we again see what was observed in the previous graphs with the interval widths. We can again see that the prediction intervals are larger as the price of the houses increases, interestingly, it’s important to note that the prediction intervals are shorter when the estimator is more certain.

Total running time of the script: ( 2 minutes 28.266 seconds)